-

Unique approach

Access bank data and simplify your identity reconciliation process to enhanced the conversion rate of your clients path and smooth client experience.

-

Better performance in enrolment rates

Make your registration process easier and faster, your conversion rates are directly and positively impacted.

-

Streamlining of KYC, KYB and onboarding processes

Pre-populate identity information in pathways and streamline the user experience with bank synchronisation

Simplify identity reconciliation procedures

Our mission is to put banking data to work for your business. With our bank data access technology, we can simplify your identity reconciliation process to improve conversion rates and enhance the customer experience.

-

Improved enrolment performance

By making your registration process easier and faster for your customers, your conversion rates are directly and positively impacted. -

Data reliability and loading speed

Our technology instantly calls up reliable, pre-verified bank data. Verification times are therefore reduced to a minimum and become almost immediate.

A seamless and frictionless journey

-

Step 1 : The customer chooses their method of identification or recognition

You can offer bank synchronisation with traditional identification methods

-

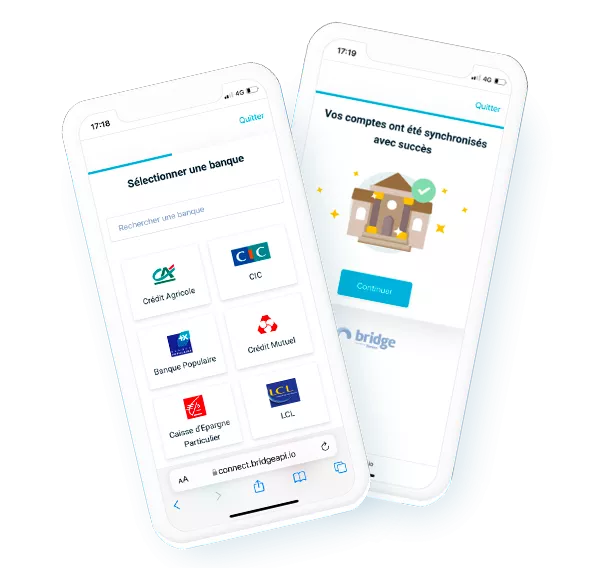

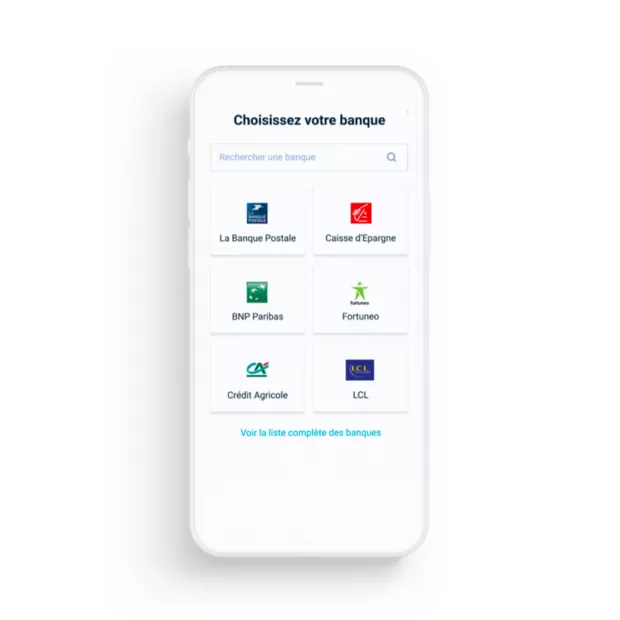

Step 2 : The customer selects his bank to perform the identification

Your customers identify themselves directly on their bank without having to share their information

-

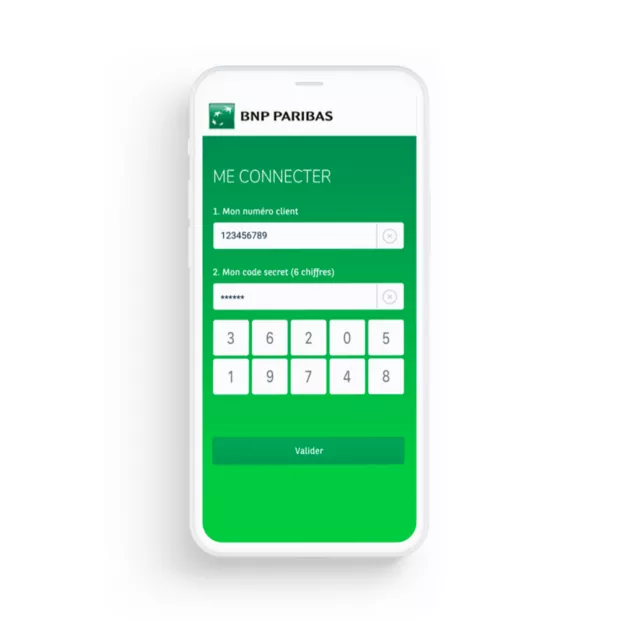

Step 3 : The customer authenticates with his bank to initiate the synchronisation

Authentication is done on a totally secure interface

-

Step 4 : Banking information is synchronised and analysed

Instant analysis of bank data enhanced by Bridge algorithms to identify your customers